Development Update: The AdEx Registry

AdEx Registry's development advances, with an audited smart contract and ongoing UI development. Scheduled for release next year, its bond-based staking system offers rewards and penalizes misconduct.

We have made progress with the AdEx Registry, here is where we’re at right now.

We have been working hard on rolling out the AdEx Registry and it is time to let you know how far ahead we are with it.

The most important piece of news is that the Registry smart contract is ready, and has been audited. We are currently working on the user interface, and the Registry will be released in the beginning of next year. This means that you will be able to stake your ADX tokens as early as Q1 2020, with the first reward distribution taking place most likely in Q2 2020.

How is staking going to work

Staking in the Registry is bond-based: each bond is a certain amount of ADX tokens locked on the smart contract. The size and duration of the bond is going to influence the rewards you’re getting.

There will be a minimum amount of tokens required to create a bond — this amount will be announced later on — but other than that, the bond amount will be flexible.

Once set, the bond amount cannot be modified (i.e. decreased or topped up). Withdrawing a partial amount of the bond will not be possible either — this means that you would need to withdraw bonds in full. Once a bond cashout is requested, it will take 1 month for the bond to mature and become withdrawable.

Rewards will be distributed on a monthly basis, and you will need to withdraw your rewards through the Registry interface.

Reward distribution mechanism and slashing

Rewards distribution will be handled off-chain: this allows multiple methods of distribution,although initially it will be through our OUTPACE payment channels.

Validators that misbehave will be penalized by slashing a portion of the staked ADX tokens. Misbehaving most often means a validator becoming unavailable — in which case a portion of the staked tokens are burned and the validator is temporarily delisted.

Slashing amounts will be determined later on — slashing won’t be enabled until Q2/Q3 2020.

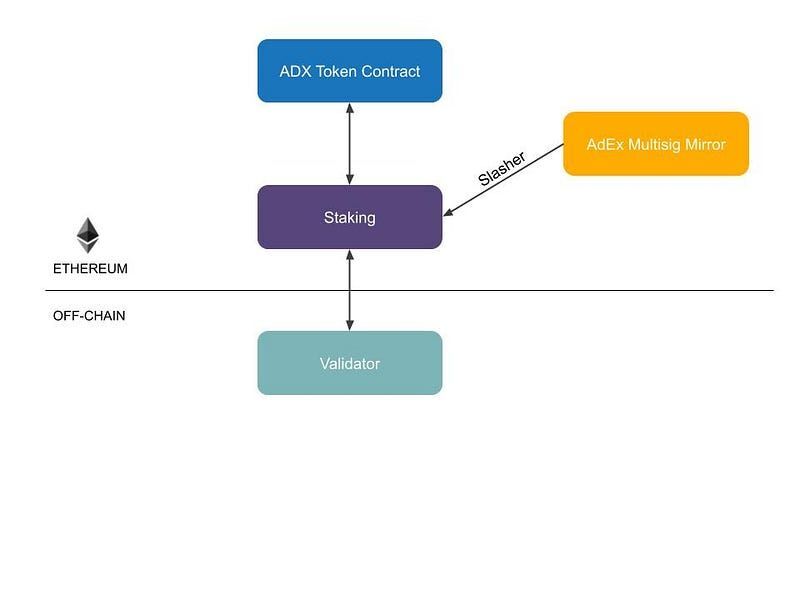

Underlying architecture

At the beginning, slashing will be handled by a mirror of an AdEx company multisig.

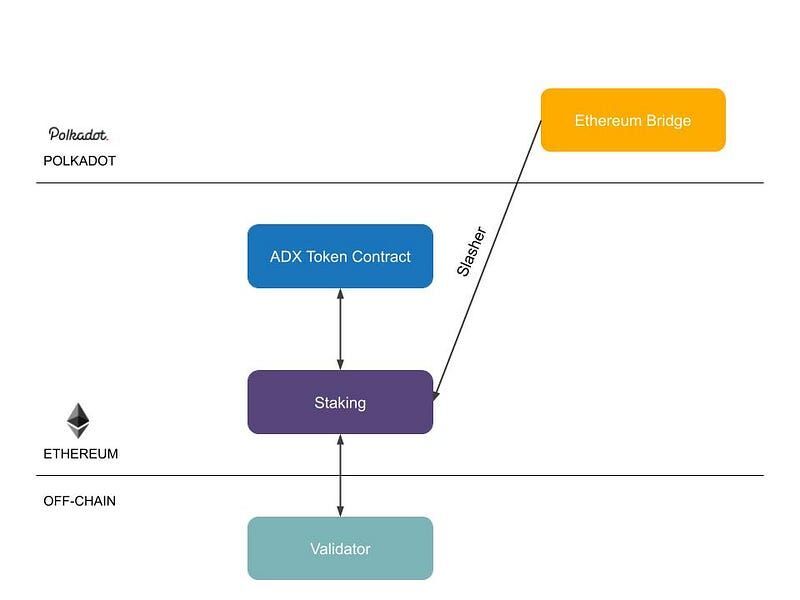

Once an Ethereum bridge on Polkadot is available, it will replace the mirror:

The slashing mechanism is essential for the AdEx Registry as it ensures validator nodes are incentivized to deliver 100% uptime — a misbehaving validator would stall the advertising campaigns it’s appointed to and will therefore affect the entire AdEx ecosystem.

Interested in AdEx? Follow us:

X (Twitter) | Telegram | Reddit | Facebook | LinkedIn | Discord