AdEx Goes to Mainnet with Chainlink Oracles Integration, Pioneers Elastic Issuance

AdEx is now live on mainnet, integrating Chainlink Oracles for a novel DeFi concept - elastic issuance. This update brings a loyalty staking pool, governance system, and predictable APY for our users.

We’re going live on mainnet with a staking pool that uses a Chainlink-powered ADX-USD price oracle

In August this year, we announced our upcoming integration with Chainlink for validator uptime verification and publisher staking. Both the AdEx and Chainlink teams are working on implementing these integrations, however, in the meantime we are going live on mainnet with an AdEx staking pool that uses a Chainlink-powered ADX-USD price oracle for a novel DeFi concept we call elastic issuance.

Introducing the AdEx Loyalty Pool and Governance

In the past few months, we have been working hard on the AdEx staking ecosystem and we’ve reached the stage when we are launching a loyalty staking pool and governance system.

This pool features no lockup period, predictable APY (10% — 50% depending on ADX price), tokenized staking through pool tokens, and it paves the way for community-driven AdEx governance!

Unlike the existing Validator Tom staking pool, the new loyalty pool has no lockup period and can be entered/exited at any time. The pool’s purpose is to incentivize holders to migrate their ADX and keep their ADX safe by holding their own keys, rather than keeping ADX on an exchange, and more importantly to participate in the governance of the AdEx Protocol and Network.

Elastic Issuance and Predictable APY

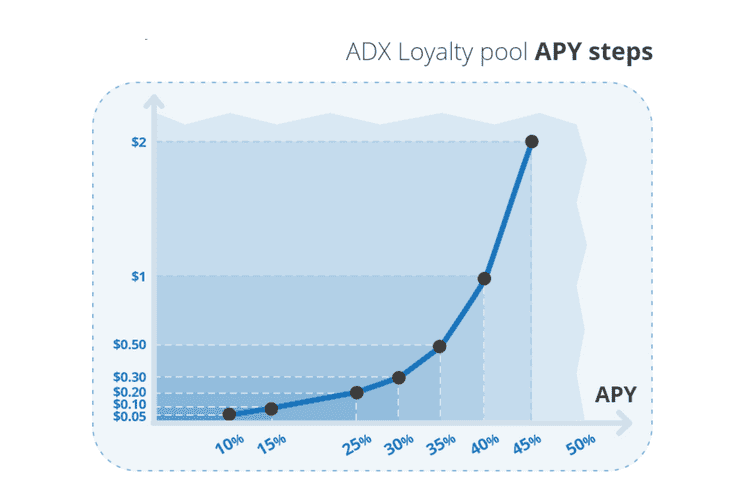

The loyalty pool annual percentage yield (APY) will range from 10% to 50% depending on the ADX price in steps.

This is achieved through elastic issuance, a DeFi concept that we pioneered in order to ensure that pool participants are incentivized to stay in while the price is high, but also to decrease excessive issuance if the price is low.

To get this price information on the LoyaltyPool smart contract, we are using and supporting the Chainlink ADX-USD Price Feed. We selected Chainlink because its price feeds are aggregated from numerous high-quality data sources, secured by a decentralized network of highly reliable Sybil resistant nodes, and operated in a transparent manner that all of our users can independently verify as fair and accurate.

With the data derived from the oracle, we will implement the following APY steps based on the ADX price:

You can check the full table of steps here in the smart contract.

Limited Participation

To ensure that not too many new ADX tokens are issued while still keeping a predictable APY, we’re limiting this pool to 25 million ADX.

This works on a first-come first-serve basis: once the limit has been reached, new participants cannot enter the pool.

Pool Tokens

Unlike regular validator pools, the loyalty pool is tokenized. This means it wraps ADX in its own token (ADX-LOYALTY) that can be transferred, traded, locked for governance or otherwise interacted with, to take advantage of the vibrant DeFi ecosystem on Ethereum.

This token is essentially an interest-bearing ADX derivative, similar to the Yearn Finance vault system.

Additional Rewards

Other than the 10–50% predictable APY, the loyalty pool carries the ability to receive and redistribute any ADX sent to it. This means that it can be used for distributing additional rewards to ecosystem participants.

For example, when there are multiple validator pools, the pool creator may choose what happens to slashed ADX beforehand: whether they get burnt or they get sent to the loyalty pool.

Furthermore, this could be used to redistribute network income to governance participants via a buyback-and-make model.

Governance

Thanks to snapshot.page, loyalty pool participants (ADX-LOYALTY holders) can vote on various proposals related to the development of AdEx, both the underlying protocol and the ad network on top of it.

Proposals will be submitted by the AdEx team and voted on by the community, and based on this signalling we’ll make decisions regarding the road ahead.

At this stage, proposal voting outcomes are not binding, unless explicitly marked as such.

This governance mechanism can be used to change the pool parameters, such as loyalty pool price-issuance steps, Validator Tom pool staking incentives, publisher and advertiser incentives, etc.

Smart Contracts and Audits

The AdEx loyalty pool contract has been audited — but as we’ve seen multiple times in the crypto space, audits do not guarantee security.

This is why, as with any other contract we’ve launched on mainnet, we perform extensive internal reviews and we ensure there’s full test coverage including adverse cases.

About Chainlink

Chainlink is the most widely used and secure way to power universal smart contracts. With Chainlink, developers can connect any blockchain with high quality data sources from other blockchains as well as real world data. Managed by a global, decentralized community of hundreds of thousands of people, Chainlink is introducing a fairer model for contracts. Its network currently secures billions of dollars in value for smart contracts across the decentralized finance (DeFi), insurance and gaming ecosystems, among others.

Chainlink is trusted to deliver definitive truth by hundreds of organizations to provide continuous, reliable data feeds. To learn more, visit chain.link and follow @chainlink on Twitter.

Interested in AdEx? Follow us:

X (Twitter) | Telegram | Reddit | Facebook | LinkedIn | Discord